Pathway to Zero Emissions for LPG

12 March 2023

SYNOPSIS OF HEADLINE DATA

Frontier Economics' 'LPG's Path to Zero Emissions' is seminal research that identifies no fewer than eight pathways for LPG to decarbonise that are clear, commercially-viable and relatively easy. This enables LPG to assume a unique position within the gas sector and, indeed, in comparison to many sectors.

LPG supply can begin this transition as soon as 2025-26, offering governments another important string in their bow to deliver on 2030 targets and beyond. We see these developments as complementary to government objectives in shifting to renewable energy, while offering customers diversity in choosing the zero energy sources that suit their settings.

Importantly, we have made it clear to all governments that the LPG sector is not seeking any government funding. That is, we require no subsidies, seed or project funding or the like to facilitate the transition.

We simply seek a level playing field. That is, recognition and inclusion of bioLPG, rLPG and rDME technologies in the array of government considerations, programs and mechanisms so homeowners and businesses can choose the path to zero best for them.

LPG Use in Australia

To appreciate the opportunities bioLPG, rLPG and rDME provide to homeowners, businesses and governments, it is important to understand how LPG is used in Australia today.

LPG use is, perhaps, more prevalent than many think. Looking at the baseline data provided by the Australian Bureau of Statistics' Environmental Issues: Energy Use and Conservation, March 2014, it showed that 1,775,000 homes (56% in regional areas) relied on LPG for indoor cooking, hot water and heating. This was the last time ABS reported the data.

However, as the state-by-state data from the Department of Industry, Science, Energy and Resources 2021 Residential Baseline Study (below) shows, demand for in-home uses of LPG has consistently grown year-on-year across all jurisdictions except Tasmania.

Comparing the average use by household in each jurisdiction to account for local demands, in 2021 more than 2,026,450 Australian homes relied on LPG for indoor cooking, hot water and heating. This does not include the ACT, which is omitted in the report due to the concentration of providers in that marketplace.

- New South Wales: The reliance on LPG has grown steadily since 2008, with 532,000 households (almost 16% of all homes) now utilising it for in-home cooking, hot water, and heating. The continuous growth underscores the confidence placed in LPG as a dependable energy source across the state.

- Victoria: In 2021, 356,600 Victorian households (more than 12.5% of all households) relied on LPG for indoor purposes. The widespread use of LPG has established it as a fundamental energy source, supporting various household needs.

- Queensland: Queensland boasts the highest reliance on LPG among Australian states, with 607,000 households (over 27.5% of all homes) embracing it for their energy needs. This demonstrates the integral role LPG plays in sustaining a significant portion of Queensland's households with reliable energy solutions.

- South Australia: LPG's versatility and efficiency are evident in South Australia, where 153,700 households (19% of all homes) benefit from its usage. This indicates a substantial portion of the population recognising and embracing LPG for its reliability in meeting various energy demands.

- Western Australia: LPG is a prevalent choice, with approximately 327,000 households – or over 28% of homes – relying on it for their energy requirements. This significant number reflects a consistent upward trend in LPG adoption, highlighting its importance in the state's energy landscape.

- Tasmania: Despite its smaller population, Tasmania showcases a notable presence of LPG usage, with 29,000 households (over 11% of all homes) depending on it for essential energy services. The utilisation of LPG in Tasmania underlines its role in catering to diverse household needs across different regions.

- Northern Territory: 20,703 NT homes use LPG for in-home cooking and hot water – 21.5% of all homes across the Territory.

LPG is, typically, relied on due to the absence of mains natural gas and/or electrification not being applicable to needs. Further applications include:

- Commercial: space heating, water heating, commercial kitchens (restaurants, cafes, clubs, fish and chip shops), hospitals, schools, catering vans, and increasingly as shipping fuel.

- Industrial: process heat for manufacturing (ovens, furnaces) for metal processing, as well as feedstock (glass, plastic, metals, fertilisers, pharmaceuticals, to list just a few).

- Agricultural: power equipment (i.e. water pumps) and heating (crop drying, animal rearing, greenhouse heating).

- Recreational: 6 million BBQs, 72,000 campervans, 669,400 caravans, as well as camping equipment, boating, outdoor heating and hot-air ballooning.

In all, there are more than 20 million LPG cylinders in circulation across Australia, servicing these sectors every day.

All can easily be changed to bioLPG and/or rLPG as 'drop in' replacements for conventional LPG. That means no extra capital costs to homeowners, businesses or anyone using it. Existing cylinders, pipes and appliances require no changes.

Similarly, rDME can be blended with LPG, bioLPG or rLPG up to 20% of capacity without any changes to equipment, providing another element of renewable flexibility.

Examples for LPG to Achieve Net Zero & Actual Zero Emissions

BioLPG:

- Derived from plant and vegetable waste.

- Derived as a by-product of Sustainable Aviation Fuel production using the Hydrotreated Vegetable Oil process.

- Identical to LPG. A simple 'drop in' replacement.

- Same storage, transport infrastructure and appliances. No change. No additional capital costs.

- Net zero as an 80% renewable gas.

- Potential to be actual zero as related sectors (i.e. transport) reduce their emissions.

rLPG:

- Synthetically produced from green hydrogen and CO2 taken from the atmosphere.

- Identical to LPG. A simple 'drop in' replacement.

- Same storage, transport infrastructure and appliances. No change. No additional capital costs.

- Is an actual zero gas – that is, the only CO2 expended in its use is what was captured in its creation. No offsets are required.

rDME:

- Derived from methanol.

- Chemically similar to LPG (propane and butane).

- Can be blended with rLPG up to 20% with no change to appliances.

- It can fully replace LPG, however, would require minor changes to existing appliances.

- Derived from gasification and catalytic synthesis or electrolysis (i.e. green H2) and catalytic synthesis.

- As described above, it is net zero, but can be actual zero as related sectors (i.e. transport) reduce their emissions.

Timeline for Transition

Internationally, the transition is already underway.

Case Study 1: BioLPG Consumption - Europe:

Europe is by far the largest consumer of HVO in the world presently and it is forecast that demand for HVO will only continue to grow throughout the 2020s. A high proportion of demand is driven by the transport sector, with bioLPG being made available at petrol stations and bioLPG vehicles operating in a number of jurisdictions.

BioLPG is also increasingly being made available for purchase in cylinders for a range of off-grid leisure activities as well as industrial heating. In partnership with SHV Energy, Circle K in Sweden since mid-2020 has provided 100% bioLPG cylinders across all its stores.

Rural and regional homes and hospitality venues across the UK and Ireland are also increasingly adopting bioLPG for use in their kitchens as well as for water heating and space conditioning functions. Examples include Montalto Estate and BrookLodge & Macreddin Village in Ireland.

BioLPG has also emerged as an important energy source in the industrial sector. For example, La-Roche-Posay in France became the first industrial site in France to use bio-LPG in 2018. Since 2019, the facility now emits no greenhouse gas emissions, with the switch to bioLPG representing the last step towards carbon neutrality.

Further, the emergence of Biodiesel and Sustainable Aviation Fuel (SAF) are growing internationally.

Sustainable Aviation Fuel & BioLPG in Australia

BioLPG is a by-product of Biodiesel and SAF production using the Hydrotreated Vegetable Oil (HVO) production method. This by-product represents 10% of total Biodiesel/SAF production. This represents the low-hanging fruit, in that, these will be major new industries for Australia and the by-product of bioLPG a clear opportunity for Australia to responsibly capitalise on.

As the CSIRO's 'Sustainable Aviation Fuel Roadmap' (August 2023) makes clear, there is currently enough feedstock in Australia to supply approximately 5 billion litres of SAF production every year. This task, according to the CSIRO, could ultimately be shared among some 30 production facilities based on available feedstock.

While Australia is late to the opportunities SAF provides, there has been a 33,000% increase in exports of Australian used-cooking oil over the last two years to service international SAF producers.

It is estimated that Australian airlines will need around 6 billion litres of SAF each year, while the local companies developing SAF will also be eyeing expansion into export markets. While the HVO process will not be the only means to produce SAF, Australia boasts ample feedstock that can be drawn upon, meaning there will be a lot of Australian-produced bioLPG over coming years.

Technologies for LPG to Decarbonise

The modelling undertaken by Fronter Economics in details eight paths for the LPG sector to decarbonise, charting a clear, commercially-viable and relatively easy transition to net zero renewable gas (over the short-term) and actual zero renewable gas (from the mid-2030s).

The technologies to achieve these outcomes are clear:

1. Hydrotreating. Converts vegetable oils (seeds and waste) to biodiesel, SAF and other hydrocarbons by combining them with H2. This process produces BioLPG as a by-product up to 10% of production volumes. A ready-made First-Generation replacement for cLPG.

2. Gasification and Fischer-Tropsch: Synthetic gas from H2 and organic carbon through a thermochemical process, converting syngas into liquid hydrocarbons – all from municipal waste, sewage, food waste, crop residues, waste water, straw and manure. This would typically be used for biodiesel and SAF – with up to 10% of output producing rLPG as the by-product.

3. Gasification with Methanation: Similar to gasification with F-T above, rLPG is produced from the production of syngas, sourced from bioenergy feedstock, for a liquid fuel. Methanation involves the reaction of H2 and carbon dioxide in syngas at high heat and pressure to produce water and hydrocarbons. Sourced from a range of waste streams, sewage, agricultural/municipal waste, food waste, crop residues, waste water, straw and manure.

4. Oligomerisation: Converting methane into hydrocarbons to produce BioLPG.

5. Digestion: Using the digestion of organic matter to produce biogas. Then apply the FT process to produce hydrocarbons to produce rLPG (propane and butane). Sourced from a range of waste streams, sewage, agricultural/municipal waste, food waste, crop residues, waste water, straw and manure.

6. Pyrolysis: Similar to gasification, but at lower heats to produce bio-oil (not syngas). Hydrotreating the bio-oil produces liquid fuels, including bioLPG. Again, sourced from a range of waste streams, agricultural/municipal waste, food waste, crop residues, waste water, straw and manure.

7. Fermentation: Involves microorganisms fermenting sugars to produce bio-based isobutene, to produce a component of rLPG. Using sugars and starch from cellulose.

8. Power-to-X: producing green H2 using renewable power, then synthesizing the H2 with carbon dioxide (for instance using the F-T process) to produce liquid hydrocarbons, including rLPG. Sourced from renewable electrolysis (H2 from H2O) and CO2 capture.

rDME Development

- Derived from methanol. Produced from a wide range of bioenergy and renewable feedstock – human and agricultural wastes.

- Chemically similar to propane and butane – same storage and transport infrastructure.

- Can be blended up to 20% of LPG, bioLPG or rLPG with no change to appliances or equipment. At more than 20% some minor modification to appliances is required, i.e. changing jets.

The assumed pathways to produce rDME include:

1. Gasification and catalytic synthesis: DME produced from syngas via two steps: methanol synthesis from syngas via hydrogeneration and the water-gas shift, followed by the dehydration of methanol to produce DME. rDME is produced when syngas comes from bioenergy feedstock.

2. Electrolysis and catalytic synthesis: Similar to the above, except methanol is produced from carbon dioxide and green H2 powered by renewable energy to produce rDME.

Both pathways have the potential to produce rDME with zero emissions. rDME has been commercially available in the US since 2021 and retailers since 2022.

Case Study 2: rDME in the United States:

A world-first project, from mid-2021 Oberon Fuels began producing rDME in San Diego, California. RDME is now commercially available for consumption in the United States, with retailers such as Suburban Propane making rDME available to consumers since 2022*.

Update: Oberon is making rDME from renewable feedstocks, like biogas and organic wastes, supplying LPG firms worldwide. Using the Oberon process, and depending on the feedstock, they are delivering rDME fuel with a 60% lower carbon intensity (CI). However, they are also delivering negative carbon intensity (CI) rDME. The California Air Resources Board (CARB) estimated the Oberon process can make rDME with minus 278 CI.

LPG Path to Zero

Based on these technologies, there are many combinations for the LPG sector to pursue and achieve zero emissions.

Typically, to achieve net zero energy requires offsets. However, these technology pathways show how LPG, as a closed loop process, can be actual zero. That is, capturing the same CO2 in its production that is expended when it is used – meaning no offsets are needed.

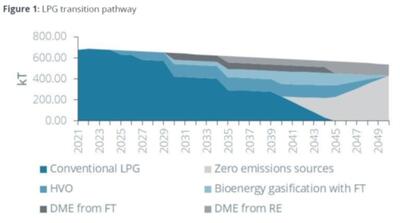

The Frontier Economics modelling charts one path, comprising of:

1. BioLPG produced as a by-product of biodiesel or SAF through the hydrotreated vegetable oil (HVO) process – from 2025-26.

2. BioLPG produced as by-product of biodiesel or SAF through gasification with the Fischer-Tropsch process – by 2030.

3. rDME produced from biomass blended – by 2030.

4. rDME produced from renewable energy blended – by 2035.

5. rLPG produced through a Power-to-Liquids pathway – by 2035.

6. LPG phased-out and replaced by bioLPG and rLPG – by 2045.

7. Only rLPG in market by 2050.

The assumed transition pathway is illustrated in the figure above.

First Cab of the Rank – Biodiesel/SAF from HVO

Case Study 3: European HVO Production

As of 2021, pure HVO is available in nine European countries: Belgium, Denmark, Finland, Estonia, Latvia, Lithuania, the Netherlands, Norway and Sweden. For off-road purposes it is also available in Germany, the UK and Switzerland.

In 2019, approximately 1.9 million tonnes of HVO was consumed across Europe where the biggest consumers were France, Norway, Spain and Sweden.

Standalone HVO production capacity is presently around 3.5 million tonnes across Europe, with new production plants and capacities proposed and forecast, this figure is expected to rise. The Netherlands currently has the largest HVO production plant (Neste, Rotterdam) with new production plants also proposed in the coming years in France, Italy, Sweden and Finland.

Co-processed HVO is also prevalent across the continent with a current production capacity of around 1.8 million tonnes (the majority of which is concentrated in Spain).

In Australia, it is expected that bioLPG from the HVO process will come as a by-product of production of biodiesel and/or SAF, as is the case globally. Production and use of Biodiesel and SAF are likely to increase as part of the transition to net zero as transport industries seek to lower their emissions.

At the time of the release of the Frontier Economics modelling, there were three sizeable Biodiesel and SAF projects in the planning for Australia, including:

- Sherdar Australia Bio Refinery (Qld): Sherdar Australia is currently proposing to develop Australia's first biodiesel refinery and storage plant. There is currently no location for the project, however the proposal would cost $600 million, and the site would be able to produce 500,000 tonnes per year of biodiesel and SAF upon completion. Proposed feedstocks for production at the site include animal fats, seed oil and waste greases.

- BP renewable fuel and green hydrogen project (WA): BP is currently proposing to establish a renewable fuel and green hydrogen site in the Kwinana industrial site in Western Australia. The project would involve repurposing a fuel import site to produce 8,000-10,000 barrels of biodiesel and SAF per day from products such as waste oil, tallow and used cooking oil.

- Oceania Biofuels Project, Gladstone (QLD): Gladstone, Queensland was selected as the site in April 2022 for a $500 million biodiesel and SAF refinery. The project proposes to use locally sourced tallow, canola and used cooking oil to produce 350 million litres of SAF and biodiesel per year. Construction is planned to begin in 2023 and operations by 2025 .

Under this assumed transition pathway, bioLPG from HVO becomes available from 2025-26, bioLPG from gasification with FT and rDME from biomass from 2030, rDME from green hydrogen and rLPG from Power-to-Liquids (or synthetic rLPG) by the mid-2030s.

The supply of conventional LPG is steadily phased-out in favour of these net zero and, ultimately, actual zero emission alternatives. All conventional LPG supply is phased-out entirely by 2045. By 2050, zero emission sources are the only sources of supply still in the market.

Since the public release of the Frontier Economics modelling in March 2023, additional biodiesel and SAF projects have been announced for Australia. Notably, in March 2023, GEA Member AMPOL entered into a Memorandum of Understanding with ENEOS to explore the production of advanced biofuels at the Lytton refinery in Brisbane.

In March 2023, Qantas, Airbus and the Queensland Government announced they will contribute to a $6 million feasibility study to explore the creation of a $400 million ethanol-based sustainable aviation fuel plant in north Queensland.

The CSIRO's 'Sustainable Aviation Fuel Roadmap' forecasts capacity for 30 SAF plants across Australia, drawing on available feedstock, to produce 5 billion litres of SAF each year.

Clearly, the transition to SAF in Australia is in its infancy, however, the reality is it will grow to be major new domestic industry. Even based on the initial production runs of the Sherdar, BP and Oceania projects alone, these will produce 134,880,000 litres of bioLPG a year.

To put this production into perspective, if sold into the LPG market this net zero bioLPG would replace 11% of current LPG demand in Australia virtually overnight. This would represent immediate carbon abatement of up to 160,000 tonnes of CO2-e per year from 2025-26, growing in line with production. This would increase as export markets for biodiesel and SAF are developed.

If this production grew to see bioLPG replace all conventional LPG, the abatement would be up to 1.5 million tonnes CO2-e each year.

Again, as renewable actual zero rLPG replaces all LPG use, the abatement achieved is 1.94 million tonnes CO2-e per year. Providing flexibility to families, businesses and governments, while alleviating pressure on the electricity grid.

The full Frontier Economics Report 'Path to Zero Emissions for LPG' is available below...

File downloads

Next Hot Issues:

12/3/2023 LPG charts path to zero emissions across Canberra by 2045

Previous Hot Issues:

12/1/2023 Draft Future Gas Strategy for Tasmania